Get the free onett computation form

Show details

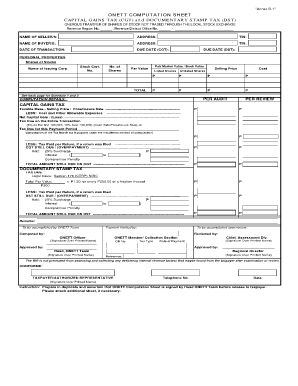

CONFORME TAXPAYER/AUTHORIZED REPRESENTATIVE Telephone No. Date Instruction Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer. M. AREA Zonal Value ZV DUE DATE DST Fair Market Value FMV per TD Tax Base Selling Price SP ZV/FMV/SP whichever is higher TOTAL PER AUDIT COMPUTATION DETAILS PER REVIEW TAX DUE Legal basis Sections 24 D 1 25 A 3 27 D 5 P x 6. 0...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non income form

Edit your capital income gains form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax gains form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit capital tax income online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bir onett computation sheet form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out onett computation sheet form

How to fill out Onett Computation Sheet

01

Begin by gathering all required financial documents and data.

02

Open the Onett Computation Sheet on your computer or device.

03

Enter the date of the computation at the top of the sheet.

04

Fill in the personal details section with your name, address, and contact information.

05

Input your income sources in the designated income section, ensuring accuracy.

06

List your expenses in the expense section, categorizing them appropriately.

07

Calculate the total income and total expenses to determine net income.

08

Review all entries for accuracy and completeness.

09

Save the completed sheet and make a copy for your records.

10

Submit the Onett Computation Sheet to the relevant authority or keep it for personal use.

Who needs Onett Computation Sheet?

01

Individuals preparing their personal tax returns.

02

Small business owners calculating their financial performance.

03

Accountants and financial advisors assisting clients.

04

Students or professionals studying finance and accounting.

05

Anyone needing to document and analyze their financial situation.

Fill

taxable taxation calculation

: Try Risk Free

People Also Ask about capital gains exclusion

How much is CGT and DST in Philippines?

CAPITAL GAINS TAX (CGT): 6% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher. DOCUMENTARY STAMP TAX (DST): 1.5% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher.

Where do I pay capital gains tax on real estate?

1706) shall be filed and paid within thirty (30) days following the sale, exchange or disposition of real property, with any Authorized Agent Bank (AAB) or Revenue Collection Officer (RCO) of the Revenue District Office (RDO) having jurisdiction over the place where the property being transferred is located.

What Onett means?

The following One-Time Transaction (ONETT) taxpayers who are not eFPS registered are required to use eBIR Forms: a. Taxpayers who are classified as real estate dealers/developers; b. Taxpayers who are considered as habitually engaged in the sale of real property; and.

How much is the capital gains tax in the Philippines 2022?

For real property - 6%. Mandatory Requirements: TIN of Seller/s and Buyer/s; One (1) original copy for presentation only) Notarized Deed of Absolute Sale/Document of Transfer but only photocopied documents shall be retained by BIR; (One (1) original copy and two (2) photocopies)

How do I pay my CGT and DST Philippines?

5 steps on processing the CGT and DST in BIR STEP 1 SUBMIT: Submit the following documents at the Bureau of Internal Revenue Regional District Office (BIR RDO) that handles the property's location: STEP 2 CALCULATE: STEP 3 FILL OUT: STEP 4 PAYMENT: STEP 5 CLAIM:

How to compute capital gains tax and documentary stamp tax?

CAPITAL GAINS TAX (CGT): 6% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher. DOCUMENTARY STAMP TAX (DST): 1.5% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 000 tax income to be eSigned by others?

Once your taxable taxation is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the onett computation online in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your capital non gains in minutes.

How do I edit capital tax non straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing onett tax, you need to install and log in to the app.

What is Onett Computation Sheet?

The Onett Computation Sheet is a financial document utilized for the calculation and reporting of tax obligations for individuals and businesses to ensure compliance with tax regulations.

Who is required to file Onett Computation Sheet?

Individuals and businesses that are subject to specific tax regulations and are required to report their income and expenses for tax assessment are mandated to file the Onett Computation Sheet.

How to fill out Onett Computation Sheet?

To fill out the Onett Computation Sheet, gather all necessary financial information, accurately input your income and deductions in the designated fields, ensure all entries are correct and complete, and then submit it to the relevant tax authority.

What is the purpose of Onett Computation Sheet?

The purpose of the Onett Computation Sheet is to provide a structured method for individuals and businesses to calculate their taxable income and ensure transparency and compliance with tax laws.

What information must be reported on Onett Computation Sheet?

The Onett Computation Sheet must report information such as total income, allowable deductions, credits, and any other relevant financial data necessary for tax computation.

Fill out your Onett Computation Sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

000 Tax is not the form you're looking for?Search for another form here.

Keywords relevant to bir onett forms

Related to onett computation sheet bir form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.